Selling your house in Durham can be simple when using a rent to own contract! There are a number of excellent benefits to selling this way that homeowners don’t always realize. Keep reading to learn more about some of these great benefits in our latest post!

Attracting qualified buyers is key to a successful rent-to-own deal, and the option fee plays a crucial role. While it secures your commitment to selling, an unrealistic amount can backfire. Remember, if a buyer can’t secure a traditional mortgage due to lacking down payment, they likely won’t have the funds for yours either.

Strike a balance by setting an option fee that:

- Is sufficient to demonstrate serious intent: An embarrassingly low fee undermines your position and might attract unreliable buyers. Aim for an amount that shows genuine commitment to purchase.

- Fits the buyer’s budget: Avoid a hefty fee that becomes a barrier to entry. Consider the property value and typical down payment requirements in your area, and aim for a percentage within that range.

- Encourages, not discourages: Your goal is to attract qualified buyers, not scare them away. Make the option fee reasonable and highlight its potential benefits – applying towards the purchase price or future rent credits.

Here are some additional tips:

- Offer flexibility: Consider tiered options with varying fee amounts and lease terms. This caters to buyers with different financial situations and needs.

- Communicate clearly: Be upfront about the fee’s purpose, its application, and any potential refundability. Transparency builds trust and attracts genuine buyers.

- Seek professional advice: Consulting a real estate agent or financial expert can help you determine a fair and competitive option fee for your specific situation.

Remember, a well-calculated option fee acts as a win-win. It secures your commitment while attracting serious buyers who are more likely to see the deal through, paving the way for a smooth and successful rent-to-own journey.

A rent-to-own agreement isn’t just a handshake deal – it’s a roadmap to homeownership. To pave a smooth path, you need a detailed contract that anticipates potential bumps and outlines responsibilities, protecting both you and your buyer. Here are some key clauses to consider:

1. Repair & Maintenance:

- Minor Fixes: Clearly delegate responsibility for regular upkeep (think leaky faucets or clogged drains).

- Major Repairs: Define what constitutes major repairs (e.g., roof leaks, broken HVAC) and who shoulders the cost.

- Timeframes: Set reasonable response times for both parties to address repairs.

2. Taxes & Finances:

- Property Taxes: Determine whether the buyer will contribute a portion of monthly rent towards property taxes or pay them in full upon purchase.

- Rent Credit Options: Consider clauses that allow rent payments to partially apply towards the purchase price, incentivizing the buyer while securing future funds for you.

3. Lease Terms & Flexibility:

- Agreement Length: Decide on a lease term that balances your wait timeline with fair opportunity for the buyer to secure financing.

- Early Purchase Option: Consider allowing the buyer to purchase before the lease ends with a pre-set penalty or discount.

4. Protecting Both Interests:

- Contingencies: Include clauses allowing either party to exit the agreement under specific circumstances (e.g., buyer loan denial, seller relocation).

- Disclosure Requirements: Ensure full disclosure of any property defects or potential issues to safeguard both parties.

5. Foreclosure & Eviction:

- Default & Remedies: Clearly outline what constitutes a default (e.g., missed rent payments), followed by steps to remedy the situation.

- Eviction Process: Detail the legal eviction process should it become necessary.

6. Addressing the Unforeseen:

- HOA Restrictions: If your property falls under HOA regulations, ensure clauses address compliance and potential violations.

- Property Modifications: Establish clear rules regarding renovations or alterations the buyer can make during the lease period.

- Natural Disasters: Consider clauses outlining responsibilities and rights in case of unforeseen events affecting the property.

By proactively addressing these points in your rent-to-own agreement, you create a transparent and comprehensive guide for a successful journey towards homeownership, for both you and your buyer. Remember, clear communication and mutual understanding are key to navigating any unforeseen challenges that may arise along the way.

References and Background Checks

While opening your home to more potential buyers through rent-to-own, due diligence is crucial. You need to ensure they can fulfill their financial commitments during the lease period. That’s where references and background checks come in.

1. Reference Checks:

- Request personal and professional references: Contacting employers, landlords, and close friends can provide valuable insights into the buyer’s reliability and past behavior.

- Verify information: Don’t just read the contact information, actually reach out and ask specific questions about the buyer’s financial responsibility, communication skills, and adherence to agreements.

2. Background Checks:

- Consider a basic background check: Depending on your risk tolerance, a basic check covering criminal history and creditworthiness can reveal red flags that merit further investigation.

- Weigh cost and benefit: Prioritize checks based on the property value and potential financial risk.

Consult A Pro

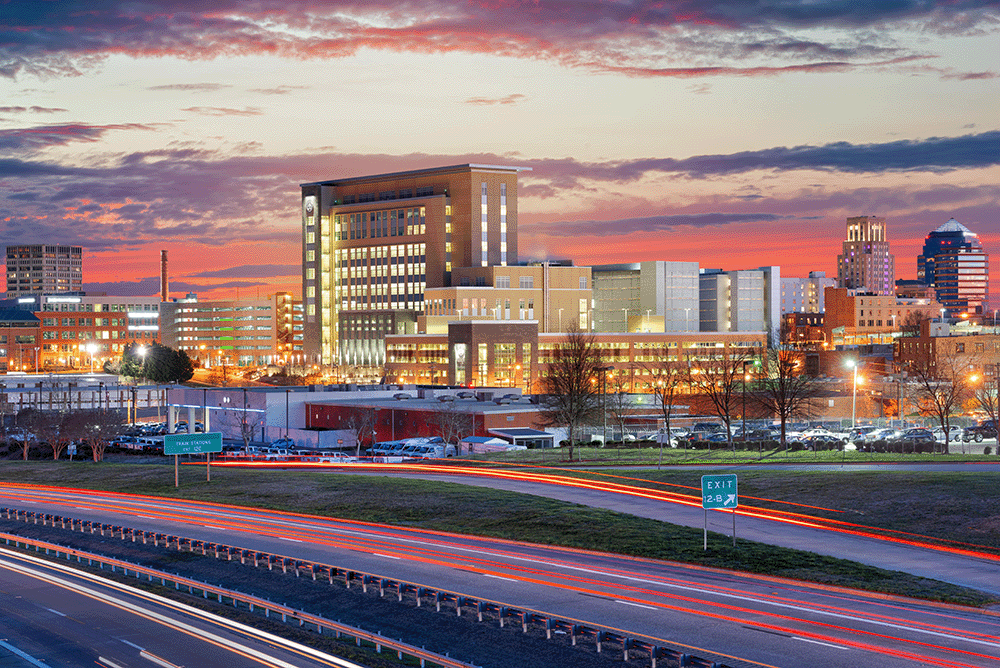

Hiring a professional such as Bull City Buyers to help you with the set up of your rent to own agreement is crucial when selling your house this way. We can help you set up the contract, find the right buyers, answer all of your questions, and make sure everything is handled legally and ethically. By utilizing our expertise in the rent to own market, you’ll finally be able to sell your house, get your asking price, and be able to create an income-producing asset for you and your family.